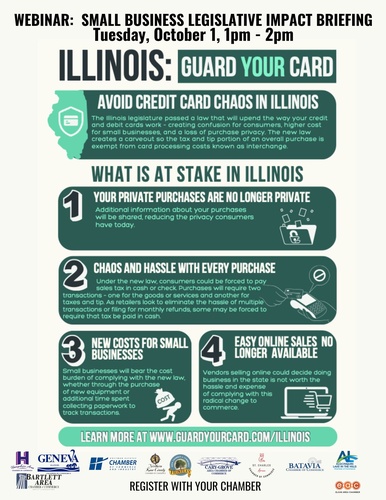

Small Business Legislative Impact Briefing: Credit Card Interchange Fees

Credit Card Interchange Fees

A new prohibition on interchange fees paid by merchants was included in Illinois HB 4951 and will go into effect in Illinois on July 1, 2025. The law forbids card networks from receiving or charging any fees on the tax or gratuity amount included in a sale.

- How will this affect your, your employees and your business?

- What do we need to know?

- When do we need to make changes?

The Zoom link is sent after you register.

More Info:

A new prohibition on interchange fees paid by merchants was included in Illinois HB 4951 and will go into effect in Illinois on July 1, 2025. The law forbids card networks from receiving or charging any fees on the tax or gratuity amount included in a sale. Currently, interchange (or swipe) fees are paid by businesses that accept credit card payments from customers, and the fee is currently charged on the total value of the bill with no consideration of sales tax included in the total and without exemption for possible tips. However, this leads to a situation where any given business is charged a fee by the card processor for collecting tax or gratuities.

The new law provides further restrictions on card processors by disallowing changes in other fees charged by card processing companies and banks which would allow them to get around the goal of this law. Once the law goes into effect, it also allows for a $1,000 civil penalty per transaction plus a refund of fees charged/ collected.

Though this law goes into effect mid- 2025, it is a good idea for Illinois taxpayers to be aware of this now and lookout for updates or guidance the state may provide. Further, merchants who accept credit card payments will want to be mindful their systems are able to track how these fees are applied, so they will have required documentation after the effective date to pursue the penalties they may be due. (Illinois H.B. 4951, Signed by JB Pritzker 6/7/2024)