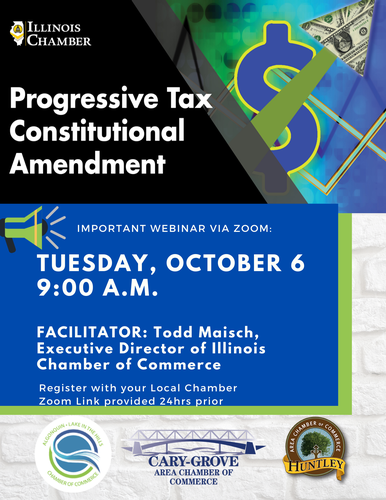

Progressive Tax - Constitutional Amendment

Name:

Progressive Tax - Constitutional Amendment

Date:

October 6, 2020

Time:

9:00 AM - 10:00 AM CDT

Registration:

Sorry, public registration for this event has been closed.

Event Description:

Hear from Todd Miaisch, Executive Director of the Illinois Chamber of Commerce as he presents on the Progressive Tax- Constitutional Amendment.

In May 2019, the legislature approved a ballot referendum question calling for a constitutional amendment to change Illinois’ constitution from a flat income tax to a progressive income tax. As a result, voters will be asked in the upcoming 2020 election whether Illinois should amend the constitution to move from a flat tax income to a progressive income tax.

The amendment also repeals a critical taxpayer protection: the constitutional ban of more than a single tax on income. Future general assemblies will be allowed to tax the same dollar of income over and over.

Although the ballot question does not contain the new tax brackets, a separate piece of legislation establishing the rates under a progressive income tax system was approved by both Houses in the General Assembly and signed by the governor. Under the proposal, corporate income would be taxed at flat rate of 10.49%, the third-highest rate in the nation, while the highest bracket for pass-through business income would be taxed at 9.49%, the fourth highest in the nation. These rates will only go into effect if the voters approve the ballot referendum question.

In May 2019, the legislature approved a ballot referendum question calling for a constitutional amendment to change Illinois’ constitution from a flat income tax to a progressive income tax. As a result, voters will be asked in the upcoming 2020 election whether Illinois should amend the constitution to move from a flat tax income to a progressive income tax.

The amendment also repeals a critical taxpayer protection: the constitutional ban of more than a single tax on income. Future general assemblies will be allowed to tax the same dollar of income over and over.

Although the ballot question does not contain the new tax brackets, a separate piece of legislation establishing the rates under a progressive income tax system was approved by both Houses in the General Assembly and signed by the governor. Under the proposal, corporate income would be taxed at flat rate of 10.49%, the third-highest rate in the nation, while the highest bracket for pass-through business income would be taxed at 9.49%, the fourth highest in the nation. These rates will only go into effect if the voters approve the ballot referendum question.